(VOVWORLD) - The Chinese economy's slower-than-expected growth in the second quarter, coupled with unpredictable monetary policies in the US and the European Union, has led many experts to predict that the global economy will face numerous challenges and uncertainties in the second half of this year.

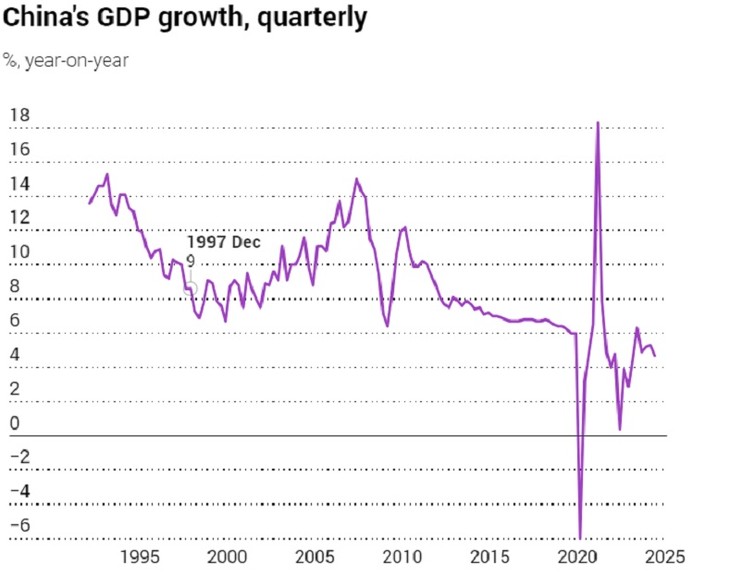

(Source: China's National Statistics Bureau) (Source: China's National Statistics Bureau) |

Recent data on China's growth and inflation in the US and Europe indicate that the largest economies continue to experience a slow, steady recovery. But there are signs that the global economy may encounter greater risks in the coming months.

China's economy: stable, slow growth

According to a report released on July 15 by China's National Bureau of Statistics, China’s GDP growth in the first half of this year was 5% more than last year. The recovery of the manufacturing sector, driven by strong external demand, was a significant factor in this growth. The industrial production index increased 6% in the first half, up 0.42% from May to June, showing a 5.3% increase from June last year. The tourism sector's recovery has also boosted domestic consumption. NBS spokeswoman Liu Aihua said:

“Overall, the Chinese economy is operating stably, making steady progress. Production grew steadily, market demand continued to recover, employment and prices remained stable, and people's incomes increased. New growth drivers are developing at a faster pace, achieving new progress in high-quality development,” said Liu Aihua.

However, China’s growth in the second quarter was only 4.7%, down from 5.3% in the first quarter and below previous forecasts. This slowdown raises concerns about the economic outlook for the second half of this year. Xing Zhaopeng, a China research expert at ANZ Bank in Shanghai, noted that the 4.7% GDP growth in the second quarter will make it difficult to achieve the target of 5% growth.

China faces barriers from trade protectionism, such as increased EU tariffs on Chinese electric vehicles. Economist Harry Murphy of Moody's Analytics urged China to address the challenges of consumer spending and a sluggish real estate market to prevent further slowing in the second half of this year. Given China's key role in global growth and trade, these uncertain signals could impact the global economy.

Fed’s hesitancy

In the face of China's slower-than-expected growth, the US economy, the world's largest, also presents unclear signals. During a hearing before the US Senate on July 9, Federal Reserve Chairman Jerome Powell projected steady US economic growth of about 2% this year but indicated that achieving the 2% inflation target remains uncertain.

Federal Reserve Chairman Jerome Powell (Photo: Bloomberg) Federal Reserve Chairman Jerome Powell (Photo: Bloomberg) |

Powell emphasized that the US economy needs better data before the Fed can start cutting interest rates, which investors have anticipated since the start of the year. He also noted the negative impacts of prolonged high interest rates on the labor market and economy, as evidenced by a slowdown in job creation in June and a rise in the unemployment rate to 4.1%. Consequently, the Fed will carefully consider any policy changes in the near future. He said that "It also matters with what's going on the labor market. If the labor market weakens unexpectedly, it could be a case for rate cut."

IMF Managing Director Kristalina Georgieva pointed out that although the US is the only G20 economy with growth above pre-pandemic levels, the rising public debt ratio is a long-term concern. She recommended that the US use the current period of stable economic growth to reduce public debt and restructure the economy. Georgieva also advised maintaining high interest rates until the end of the year.

Tim Oechsner, a capital markets strategist at Steubing AG, observed that the Fed's hesitation and unclear interest rate strategy, similar to the European Central Bank's conservative approach, have led to more cautious forecasts for the global economy in the second half of this year, diminishing the optimism seen earlier this year.